A cheap bottle-and-cap quote looks great on a spreadsheet. Then leaks, returns, and freight bills show up and eat your margin from the inside.

The hidden costs of essential oil bottles and caps come from MOQs and tooling, quality inspections and testing, component failures, logistics, compliance work, and sustainability promises that all sit on top of unit price.

If you only negotiate the piece price, you risk saving a cent and losing a dollar. The smart way is to map the full cost of ownership: from first mold drawing to the last broken bottle on a courier van.

Beyond unit price, what drives total landed cost—MOQs, tooling, AQL inspections, and leak/compatibility testing?

You can get a low per-piece quote and still lock a lot of cash in slow stock or engineering changes.

Total landed cost comes from MOQs, tooling and change fees, inspection and test programs, and the price of fixing leaks or incompatibilities that slip through.

MOQs and inventory carrying cost

Minimum order quantities sound harmless until the warehouse fills with slow movers.

- High MOQs for bottles, caps, reducers, and droppers push you to buy more than forecasts.

- That extra stock ties up cash in glass and plastic instead of marketing or R&D.

- Long lead times force you to hold safety stock, which multiplies the problem.

On top of that, packaging revisions become more expensive. Every time you update a label, color, or closure, you may scrap old components that never reached the line.

Tooling, revisions, and hidden engineering time

Custom bottles, caps, and droppers usually need molds and sometimes custom assembly tooling.

You pay for:

- Initial mold design and production.

- Engraving changes (logos, volume marks, regulatory icons).

- Maintenance and repairs when cavities wear out.

There is also internal cost:

- Packaging engineers and buyers spend time on drawings and approvals.

- Every change request can delay the launch and push back revenue.

Tooling amortization is often hidden inside the per-piece quote. If the project volume ends lower than planned, your real unit cost is much higher than it looked.

AQL inspections and stability / compatibility validation

You do not want to ship leaking oils. So you need a test program.

Direct costs:

- Incoming AQL inspections (often aligned to the ISO 2859-1 sampling standard 1) on bottles, caps, and inserts.

- Line checks for torque, neck finish, and fit.

- Stability tests for long-term sealing and material compatibility.

Indirect costs:

- Delays when a lot fails and you wait for replacements.

- Rework when finished stock needs relabeling or re-capping.

- Overtime when production windows close fast.

Compatibility tests (glass + liner + reducer + oil) also cost lab time, retain samples, and sometimes outside analytical work. Skipping them saves money today but often leads to large write-offs later.

| Driver | Cost type | Typical impact |

|---|---|---|

| High MOQs | Cash and storage | Slow stock, obsolescence risk |

| Tooling and revisions | One-off and hidden amortized | Expensive changes, launch delays |

| AQL and compatibility tests | QC labor and lab costs | Higher overhead, fewer surprises |

| Failed lots / rework | Scrap and rework labor | Direct hit to margin |

How do liners, orifice reducers, droppers, and cap springs add recurring costs through wear, failure rates, and rework?

Small components look cheap on a BOM, but they are often where leaks, complaints, and extra labor hide.

Each extra piece—liner, reducer, dropper, spring—adds material cost, assembly steps, wear points, and potential failures that can trigger rework, returns, and scrap.

Liners and sealing surfaces

Liners protect against leaks and oxygen ingress, but they are not all equal.

- PTFE, polycone, and more advanced liners cost more per piece.

- If compatibility with strong oils is not checked, liners can swell, crack, or taint the product.

- Micro-leaks from tired or damaged liners cause evaporation, greasy cartons, and angry customers.

Every leak event means:

- Replacement product and shipping.

- Customer service time.

- Possible damage to other items in the same parcel.

Over a year, a “small” leak rate can quietly erase the savings of a cheaper liner.

Orifice reducers and dripper inserts

Reducers and dripper inserts are great until they do not match oil viscosity.

- A hole that is too large causes overdosing and waste.

- A hole that is too small makes the product feel “stuck,” so people over-shake or remove the insert.

- Removing inserts by hand often breaks the seal and increases leak risk.

You also pay for:

- Extra assembly steps to insert and orient reducers.

- Higher defect and scrap rates when inserts are misfitted or fall out on the line.

Once a specific reducer is too slow or too fast for the market, you may face a full packaging change, including new molds or inserts and label updates.

Droppers, bulbs, and springs

Dropper caps and pumps use more pieces: pipette, bulb, collar, spring, and gaskets.

Hidden costs show up as:

- Breakage of glass pipettes during transport or assembly.

- Spring corrosion or sticking when oils migrate into the mechanism.

- Inconsistent dose that generates “does not work” reviews.

Pre-assembled cap + dropper sets reduce assembly labor but shift more cost into the component price, and they are less flexible if you change bottle size or neck specification.

A quick breakdown:

| Component | Hidden cost sources |

|---|---|

| Liner | Compatibility failures, micro-leaks, taint |

| Orifice reducer | Over / under dosing, extra assembly, returns |

| Dropper pipette | Breakage, dose variation, customer complaints |

| Spring / actuator | Wear, sticking, leaking around moving parts |

When you calculate total cost, it helps to add a “failure budget” for each component: expected leak rate, return rate, and rework hours. That often changes which option actually looks “cheapest.”

What logistics costs should I budget for—hazmat surcharges, DIM weight, breakage allowances, and insurance?

Essential oil packaging can look light and simple on the design screen and heavy and fragile on a pallet.

Logistics costs come from heavy glass, DIM weight rules, extra protection against breakage, hazard surcharges on oil shipments, and the insurance needed when a single carton has high value.

Weight, volume, and DIM pricing

Glass bottles concentrate a lot of weight in modest space. Carriers and freight forwarders care about both.

You pay more when:

- The bottle design is heavy for a small fill volume.

- Outer cartons are oversize because of inserts and padding.

- Pallets cannot be stacked due to fragility or height.

Parcel carriers use dimensional (DIM) weight. A bulky but light retail box may be billed as if it were heavy. That matters for DTC and e-commerce sales.

Breakage allowances and protective packing

Essential oils often ship in small, high-value units. Breakage hurts more than in commodity beverages.

Hidden items:

- Extra inner cartons, dividers, foam, or molded pulp trays.

- “Over-packing” for e-commerce to survive drops and conveyor impacts.

- The cost of ISTA or drop testing to qualify your pack (many brands benchmark against ISTA 3A packaged-products requirements 2).

Most brands quietly accept a breakage allowance, for example 1–2% of units in certain lanes. That allowance is part of your hidden logistics cost.

Hazmat surcharges and insurance

Many essential oils are treated as hazardous or at least risky due to flammability or irritation.

This can bring:

- Additional documentation and labeling.

- Surcharges from carriers or restrictions on service types.

- Higher insurance premiums for warehousing and transport.

In the US, hazard classes and shipping descriptions are commonly referenced against the 49 CFR 172.101 Hazardous Materials Table 3.

Insurance is often calculated on declared value and risk profile. If one pallet carries very concentrated, high-margin oils, the premium per shipment rises.

| Logistics factor | What to budget for |

|---|---|

| Weight and DIM | Higher freight per unit than plastics |

| Protective packing | Inserts, extra corrugate, labor |

| Breakage allowance | Replacement stock, reshipment, waste |

| Hazmat surcharges | Extra fees and restricted services |

| Insurance | Premiums tied to value and risk |

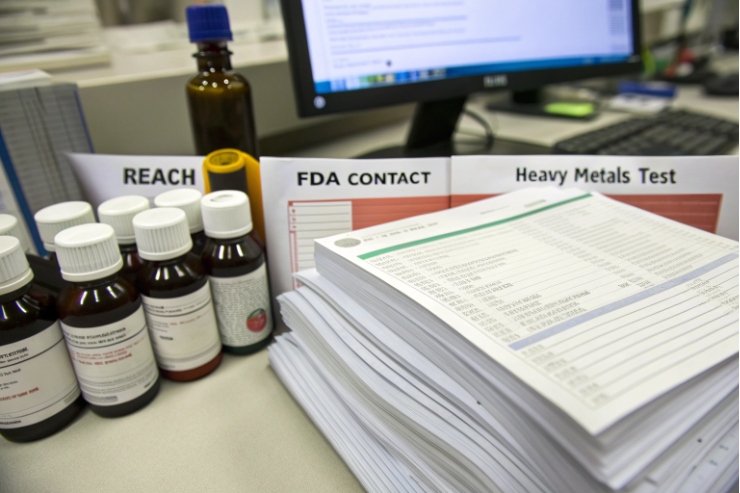

Which compliance and sustainability items raise cost—REACH/FDA, child-resistant/TE features, PCR content, and recyclability claims?

Regulation and sustainability are not only “nice stories” on the website. They come with real testing, documentation, and design constraints.

Compliance and sustainability add cost through material testing, child-resistant and tamper-evident certifications, documentation for REACH/FDA, and the price premium of PCR and mono-material designs that support recyclability claims.

Material and safety compliance

For many markets, you must show that packaging materials are safe and compliant.

This may include:

- REACH or similar declarations for glass, plastics, and coatings (see the ECHA overview of the REACH regulation 4).

- FDA or food-contact style documentation where oils may touch the cap or liner (review the FDA Food Contact Substances program 5).

- Certificates for heavy metals and other restricted substances in glass colors and decorations.

You pay for:

- Lab tests and renewals when you change suppliers or colors.

- Supplier audits, document review, and legal checks.

- Internal time to maintain a technical file for each SKU.

Ignoring this can lead to blocked shipments, recalls, or relabeling, which are far more expensive than the tests.

Child-resistant and tamper-evident features

If your oils are ingested, flammable, or sold in sensitive channels, child-resistant (CR) and tamper-evident (TE) features can become mandatory or at least expected.

In the US, many child-resistant expectations trace back to the Poison Prevention Packaging Act rules in 16 CFR Part 1700 6.

Costs include:

- Development of CR cap designs and matching bottles.

- Accredited testing with real panels to prove CR performance.

- Certification fees and ongoing quality checks to keep approval.

CR caps also have more parts and more complex assembly, which raises unit cost and sometimes leak risk if tolerances stack the wrong way.

Tamper-evident rings, bands, or shrink sleeves add:

- Extra components or materials.

- Additional machine steps and line speeds that are lower than simple capping.

- More QC points to confirm the TE feature is intact.

Sustainability, PCR, and “recyclable” claims

Sustainability adds its own hidden line items.

- PCR (post-consumer recycled) glass and plastics can cost more and show more variation.

- Mono-material designs that improve recyclability may limit decoration options and require more precise molding.

- Verified claims need data: LCAs, supplier statements, sometimes third-party labels.

There are also future-facing costs:

- Extended Producer Responsibility (EPR) fees tied to material types and recyclability (see OECD guidance on Extended Producer Responsibility 7).

- Pressure from retailers that push out non-recyclable or hard-to-recycle packs.

So a “green” bottle is not only a design choice. It is a budget item that needs to show value in brand positioning and retailer access.

A short view of these drivers:

| Area | Cost sources |

|---|---|

| REACH / FDA | Testing, documentation, audits |

| Child-resistant | Design, certification, more complex tooling |

| Tamper-evident | Bands, rings, extra line steps |

| PCR / eco design | Material premiums, yield loss, design limits |

| Recyclability | LCA work, claim validation, EPR fees |

When you treat compliance and sustainability as part of the cost model from day one, you can design packs that meet rules, support your story, and still make money.

Conclusion

Essential oil packaging is not just about a cheap bottle and cap. Real profit comes from packaging that seals, ships, complies, and recycles well, without nasty surprises between factory and customer.

Footnotes

-

Understand ISO 2859-1 AQL sampling plans to set clear inspection expectations with suppliers. ↩ ↩

-

See ISTA 3A requirements for parcel-shipped packaged products to budget realistic drop and vibration testing. ↩ ↩

-

Use the HazMat Table to check hazard classes, packing instructions, and shipping descriptions that trigger surcharges. ↩ ↩

-

Learn how REACH governs chemicals in materials, coatings, and inks to reduce compliance risk in the EU. ↩ ↩

-

Understand FDA Food Contact Substances documentation when packaging components may contact products used around mouths or food-adjacent settings. ↩ ↩

-

Review PPPA child-resistant packaging rules so your closures meet legal expectations for household chemicals and medicines. ↩ ↩

-

Get an overview of EPR policies that can add packaging fees and reporting duties in many markets. ↩ ↩